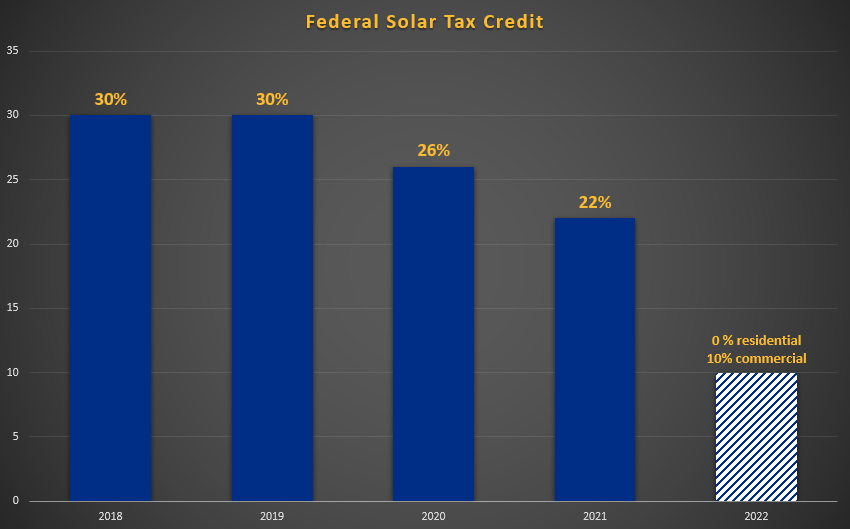

As we mentioned in a previous post, the Federal Solar Tax Credit (also know as the Investment Tax Credit or ITC) will decrease incrementally starting in 2020 and expire in 2022.

Time is running out to benefit from the full 30% Federal Solar Tax Credit! Here’s what you need to know.

Residential Solar

- For tax purposes, residential solar installation credits fall under Section 25D of the IRS Tax Code.

- Residential solar customers can claim 30% of all install costs of their system, without a dollar limit.

- The residential solar install must be “placed-in-service” on or before Dec. 31, 2019.

Commercial Solar

- For tax purposes, commercial installation credits fall under Section 45 of the IRS Tax Code.

- Commercial solar customers can claim 30% of all install costs of their system, without a dollar limit.

- The commercial solar install does not have to be completed or placed in service before Dec. 31, 2019. However, they must follow these requirements:

- Commercial solar customers must start construction of their solar install by Dec. 31, 2019 OR

- Commercial solar customers may pay 5% or more of the total cost of the solar project in the year that construction begins AND

- The commercial solar install must show continuous signs of progress, with construction completed within 4 years of construction commencement.

Time is running out to claim your 30% tax credit for installing solar! Time is running out to potentially save thousands of dollars on future energy costs!

Contact us today to learn more about how YOU could start saving!

*Note: Information within this article should not substitute the advice and counsel of your CPA or tax adviser.